The report is a complete handbook encompassing major cues on innovative growth strategies instrumented by market forerunners and their eventual implications on holistic growth pattern in Global Cloud Computing for Business Operations Market. A thorough analytical review of these winning strategies by market players ensures error-free growth spike, thereby securing their lead amidst staggering competition in Global Cloud Computing for Business Operations Market.

Also to further deliver minutest growth influencing detail in global market. A section on dynamic market segmentation is also included in the report, on the basis of which readers are presented with detailed overview of core segments such as type and application, besides a run-down on geographical presence. By segmentation analysis global market highlights details on deployment as well as on end-user applications besides regional diversification.

Access the PDF sample of the report @ https://www.orbisresearch.com/contacts/request-sample/3246677

Cloud computing is a internet-based computing where central remote servers maintain all the data and applications. Cloud computing allow business operators to rent physical infrastructure from a third party provider(cloud service provider).

According to this study, over the next five years the Cloud Computing for Business Operations market will register a xx% CAGR in terms of revenue, the global market size will reach US$ xx million by 2024, from US$ xx million in 2019. In particular, this report presents the global revenue market share of key companies in Cloud Computing for Business Operations business, shared in Chapter 3.

This report presents a comprehensive overview, market shares and growth opportunities of Cloud Computing for Business Operations market by product type, application, key companies and key regions.

This study considers the Cloud Computing for Business Operations value generated from the sales of the following segments:

Segmentation by product type: breakdown data from 2014 to 2019 in Section 2.3; and forecast to 2024 in section 10.7.

Infrastructure as a Service (IaaS)

Platform as a Service (PaaS)

Recovery as a Service (RaaS)

Segmentation by application: breakdown data from 2014 to 2019, in Section 2.4; and forecast to 2024 in section 10.8.

Private Cloud

Hybrid Cloud

Others

This report also splits the market by region: Breakdown data in Chapter 4, 5, 6, 7 and 8.

Americas

United States

Canada

Mexico

Brazil

APAC

China

Japan

Korea

Southeast Asia

India

Australia

Europe

Germany

France

UK

Italy

Russia

Spain

Middle East & Africa

Egypt

South Africa

Israel

Turkey

GCC Countries

The report also presents the market competition landscape and a corresponding detailed analysis of the major vendor/manufacturers in the market. The key manufacturers covered in this report: Breakdown data in in Chapter 3.

Amazon Web Services

Microsoft Azure

Google Cloud Platform

IBM Cloud

Red Hat

SAP Cloud Platform

Kamatera

VMware

Oracle Cloud

Salesforce Cloud

Cisco Systems

Verizon Cloud

HPE Cloud

ServiceNow

Alibaba Cloud

DigitalOcean

CenturyLink

Workday

CloudSigma

Adobe Cloud

In addition, this report discusses the key drivers influencing market growth, opportunities, the challenges and the risks faced by key players and the market as a whole. It also analyzes key emerging trends and their impact on present and future development.

Research objectives

To study and analyze the global Cloud Computing for Business Operations market size by key regions/countries, product type and application, history data from 2014 to 2018, and forecast to 2024.

To understand the structure of Cloud Computing for Business Operations market by identifying its various subsegments.

Focuses on the key global Cloud Computing for Business Operations players, to define, describe and analyze the value, market share, market competition landscape, SWOT analysis and development plans in next few years.

To analyze the Cloud Computing for Business Operations with respect to individual growth trends, future prospects, and their contribution to the total market.

To share detailed information about the key factors influencing the growth of the market (growth potential, opportunities, drivers, industry-specific challenges and risks).

To project the size of Cloud Computing for Business Operations submarkets, with respect to key regions (along with their respective key countries).

To analyze competitive developments such as expansions, agreements, new product launches and acquisitions in the market.

To strategically profile the key players and comprehensively analyze their growth strategies.

Browse the full report @ https://www.orbisresearch.com/reports/index/global-cloud-computing-for-business-operations-market-growth-status-and-outlook-2019-2024

Table of Contents

2019-2024 Global Cloud Computing for Business Operations Market Report (Status and Outlook)

1 Scope of the Report

1.1 Market Introduction

1.2 Research Objectives

1.3 Years Considered

1.4 Market Research Methodology

1.5 Economic Indicators

1.6 Currency Considered

2 Executive Summary

2.1 World Market Overview

2.1.1 Global Cloud Computing for Business Operations Market Size 2014-2024

2.1.2 Cloud Computing for Business Operations Market Size CAGR by Region

2.2 Cloud Computing for Business Operations Segment by Type

2.2.1 Infrastructure as a Service (IaaS)

2.2.2 Platform as a Service (PaaS)

2.2.3 Software as a Service (SaaS)

2.2.4 Recovery as a Service (RaaS)

2.3 Cloud Computing for Business Operations Market Size by Type

2.3.1 Global Cloud Computing for Business Operations Market Size Market Share by Type (2014-2019)

2.3.2 Global Cloud Computing for Business Operations Market Size Growth Rate by Type (2014-2019)

2.4 Cloud Computing for Business Operations Segment by Application

2.4.1 Private Cloud

2.4.2 Hybrid Cloud

2.4.3 Others

2.5 Cloud Computing for Business Operations Market Size by Application

2.5.1 Global Cloud Computing for Business Operations Market Size Market Share by Application (2014-2019)

2.5.2 Global Cloud Computing for Business Operations Market Size Growth Rate by Application (2014-2019)

3 Global Cloud Computing for Business Operations by Players

3.1 Global Cloud Computing for Business Operations Market Size Market Share by Players

3.1.1 Global Cloud Computing for Business Operations Market Size by Players (2017-2019)

3.1.2 Global Cloud Computing for Business Operations Market Size Market Share by Players (2017-2019)

3.2 Global Cloud Computing for Business Operations Key Players Head office and Products Offered

3.3 Market Concentration Rate Analysis

3.3.1 Competition Landscape Analysis

3.3.2 Concentration Ratio (CR3, CR5 and CR10) (2017-2019)

3.4 New Products and Potential Entrants

3.5 Mergers & Acquisitions, Expansion

4 Cloud Computing for Business Operations by Regions

4.1 Cloud Computing for Business Operations Market Size by Regions

4.2 Americas Cloud Computing for Business Operations Market Size Growth

4.3 APAC Cloud Computing for Business Operations Market Size Growth

4.4 Europe Cloud Computing for Business Operations Market Size Growth

4.5 Middle East & Africa Cloud Computing for Business Operations Market Size Growth

5 Americas

5.1 Americas Cloud Computing for Business Operations Market Size by Countries

5.2 Americas Cloud Computing for Business Operations Market Size by Type

5.3 Americas Cloud Computing for Business Operations Market Size by Application

5.4 United States

5.5 Canada

5.6 Mexico

5.7 Key Economic Indicators of Few Americas Countries

6 APAC

6.1 APAC Cloud Computing for Business Operations Market Size by Countries

6.2 APAC Cloud Computing for Business Operations Market Size by Type

6.3 APAC Cloud Computing for Business Operations Market Size by Application

6.4 China

6.5 Japan

6.6 Korea

6.7 Southeast Asia

6.8 India

6.9 Australia

6.10 Key Economic Indicators of Few APAC Countries

7 Europe

7.1 Europe Cloud Computing for Business Operations by Countries

7.2 Europe Cloud Computing for Business Operations Market Size by Type

7.3 Europe Cloud Computing for Business Operations Market Size by Application

7.4 Germany

7.5 France

7.6 UK

7.7 Italy

7.8 Russia

7.9 Spain

7.10 Key Economic Indicators of Few Europe Countries

8 Middle East & Africa

8.1 Middle East & Africa Cloud Computing for Business Operations by Countries

8.2 Middle East & Africa Cloud Computing for Business Operations Market Size by Type

8.3 Middle East & Africa Cloud Computing for Business Operations Market Size by Application

8.4 Egypt

8.5 South Africa

8.6 Israel

8.7 Turkey

8.8 GCC Countries

9 Market Drivers, Challenges and Trends

9.1 Market Drivers and Impact

9.1.1 Growing Demand from Key Regions

9.1.2 Growing Demand from Key Applications and Potential Industries

9.2 Market Challenges and Impact

9.3 Market Trends

10 Global Cloud Computing for Business Operations Market Forecast

10.1 Global Cloud Computing for Business Operations Market Size Forecast (2019-2024)

10.2 Global Cloud Computing for Business Operations Forecast by Regions

10.2.1 Global Cloud Computing for Business Operations Forecast by Regions (2019-2024)

10.2.2 Americas Market Forecast

10.2.3 APAC Market Forecast

10.2.4 Europe Market Forecast

10.2.5 Middle East & Africa Market Forecast

10.3 Americas Forecast by Countries

10.3.1 United States Market Forecast

10.3.2 Canada Market Forecast

10.3.3 Mexico Market Forecast

10.3.4 Brazil Market Forecast

10.4 APAC Forecast by Countries

10.4.1 China Market Forecast

10.4.2 Japan Market Forecast

10.4.3 Korea Market Forecast

10.4.4 Southeast Asia Market Forecast

10.4.5 India Market Forecast

10.4.6 Australia Market Forecast

10.5 Europe Forecast by Countries

10.5.1 Germany Market Forecast

10.5.2 France Market Forecast

10.5.3 UK Market Forecast

10.5.4 Italy Market Forecast

10.5.5 Russia Market Forecast

10.5.6 Spain Market Forecast

10.6 Middle East & Africa Forecast by Countries

10.6.1 Egypt Market Forecast

10.6.2 South Africa Market Forecast

10.6.3 Israel Market Forecast

10.6.4 Turkey Market Forecast

10.6.5 GCC Countries Market Forecast

10.7 Global Cloud Computing for Business Operations Forecast by Type

10.8 Global Cloud Computing for Business Operations Forecast by Application

11 Key Players Analysis

11.1 Amazon Web Services

11.1.1 Company Details

11.1.2 Cloud Computing for Business Operations Product Offered

11.1.3 Amazon Web Services Cloud Computing for Business Operations Revenue, Gross Margin and Market Share (2017-2019)

11.1.4 Main Business Overview

11.1.5 Amazon Web Services News

11.2 Microsoft Azure

11.2.1 Company Details

11.2.2 Cloud Computing for Business Operations Product Offered

11.2.3 Microsoft Azure Cloud Computing for Business Operations Revenue, Gross Margin and Market Share (2017-2019)

11.2.4 Main Business Overview

11.2.5 Microsoft Azure News

11.3 Google Cloud Platform

11.3.1 Company Details

11.3.2 Cloud Computing for Business Operations Product Offered

11.3.3 Google Cloud Platform Cloud Computing for Business Operations Revenue, Gross Margin and Market Share (2017-2019)

11.3.4 Main Business Overview

11.3.5 Google Cloud Platform News

11.4 IBM Cloud

11.4.1 Company Details

11.4.2 Cloud Computing for Business Operations Product Offered

11.4.3 IBM Cloud Cloud Computing for Business Operations Revenue, Gross Margin and Market Share (2017-2019)

11.4.4 Main Business Overview

11.4.5 IBM Cloud News

11.5 Red Hat

11.5.1 Company Details

11.5.2 Cloud Computing for Business Operations Product Offered

11.5.3 Red Hat Cloud Computing for Business Operations Revenue, Gross Margin and Market Share (2017-2019)

11.5.4 Main Business Overview

11.5.5 Red Hat News

11.6 SAP Cloud Platform

11.6.1 Company Details

11.6.2 Cloud Computing for Business Operations Product Offered

11.6.3 SAP Cloud Platform Cloud Computing for Business Operations Revenue, Gross Margin and Market Share (2017-2019)

11.6.4 Main Business Overview

11.6.5 SAP Cloud Platform News

11.7 Kamatera

11.7.1 Company Details

11.7.2 Cloud Computing for Business Operations Product Offered

11.7.3 Kamatera Cloud Computing for Business Operations Revenue, Gross Margin and Market Share (2017-2019)

11.7.4 Main Business Overview

11.7.5 Kamatera News

11.8 VMware

11.8.1 Company Details

11.8.2 Cloud Computing for Business Operations Product Offered

11.8.3 VMware Cloud Computing for Business Operations Revenue, Gross Margin and Market Share (2017-2019)

11.8.4 Main Business Overview

11.8.5 VMware News

11.9 Oracle Cloud

11.9.1 Company Details

11.9.2 Cloud Computing for Business Operations Product Offered

11.9.3 Oracle Cloud Cloud Computing for Business Operations Revenue, Gross Margin and Market Share (2017-2019)

11.9.4 Main Business Overview

11.9.5 Oracle Cloud News

11.10 Salesforce Cloud

11.10.1 Company Details

11.10.2 Cloud Computing for Business Operations Product Offered

11.10.3 Salesforce Cloud Cloud Computing for Business Operations Revenue, Gross Margin and Market Share (2017-2019)

11.10.4 Main Business Overview

11.10.5 Salesforce Cloud News

11.11 Cisco Systems

11.12 Verizon Cloud

11.13 HPE Cloud

11.14 ServiceNow

11.15 Alibaba Cloud

11.16 DigitalOcean

11.17 CenturyLink

11.18 Workday

11.19 CloudSigma

11.20 Adobe Cloud

12 Research Findings and Conclusion

Direct purchase the report @ https://www.orbisresearch.com/contact/purchase-single-user/3246677

About Us:

Orbis Research (orbisresearch.com) is a single point aid for all your market research requirements. We have vast database of reports from the leading publishers and authors across the globe. We specialize in delivering customized reports as per the requirements of our clients. We have complete information about our publishers and hence are sure about the accuracy of the industries and verticals of their specialization. This helps our clients to map their needs and we produce the perfect required market research study for our clients.

Contact Us:

Hector Costello

Senior Manager – Client Engagements

4144N Central Expressway,

Suite 600, Dallas,

Texas – 75204, U.S.A.

Phone No.: +1 (972)-362-8199; +91 895 659 5155

Post Views: 20

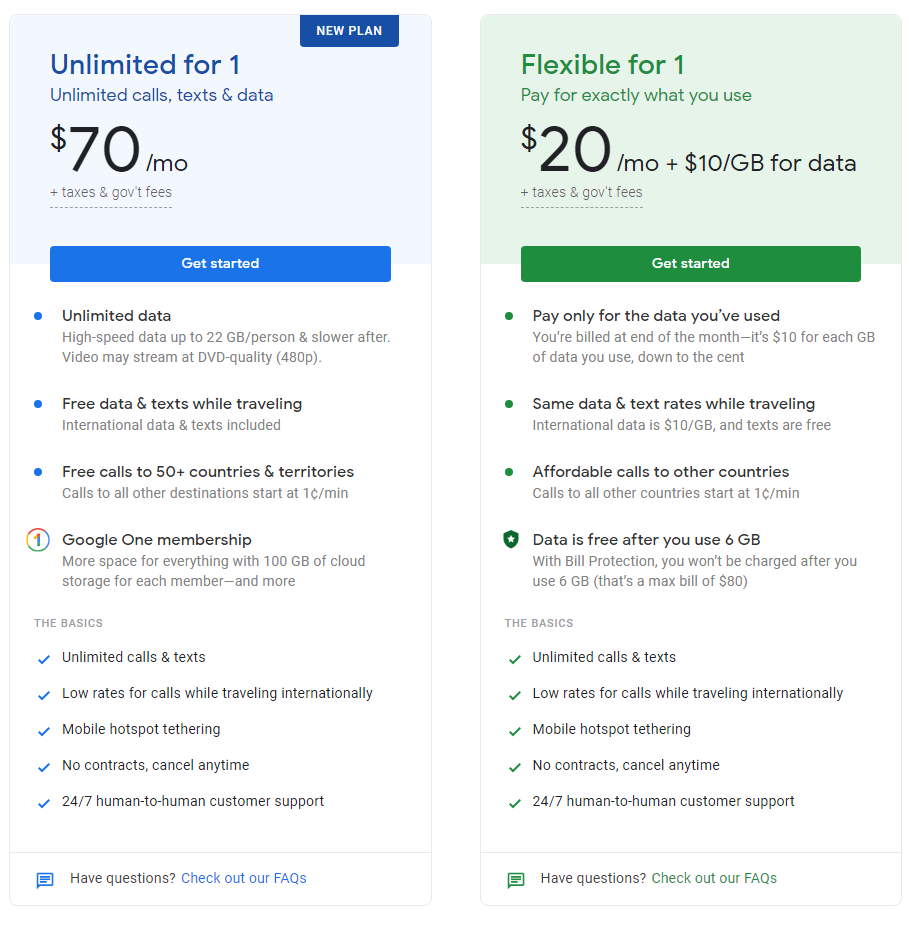

If unlimited mobile plans appeal to you, then you might be thrilled to learn that Google has announced a new unlimited plan for its Google Fi MVNO service. Given that this is Google, it won't just be a standard unlimited plan and it will actually come with the addition of a Google One subscription.

If unlimited mobile plans appeal to you, then you might be thrilled to learn that Google has announced a new unlimited plan for its Google Fi MVNO service. Given that this is Google, it won't just be a standard unlimited plan and it will actually come with the addition of a Google One subscription.